This is an update post for a previous one.

These were the recommendations from StockMonitor 2.0 on Oct 2022.

This post will show two things:

- the results for what would have happened if I had just bought and held the above stocks once in October 2022

- real results, based on tweaks and adjustments made to purchasing decisions during the year.

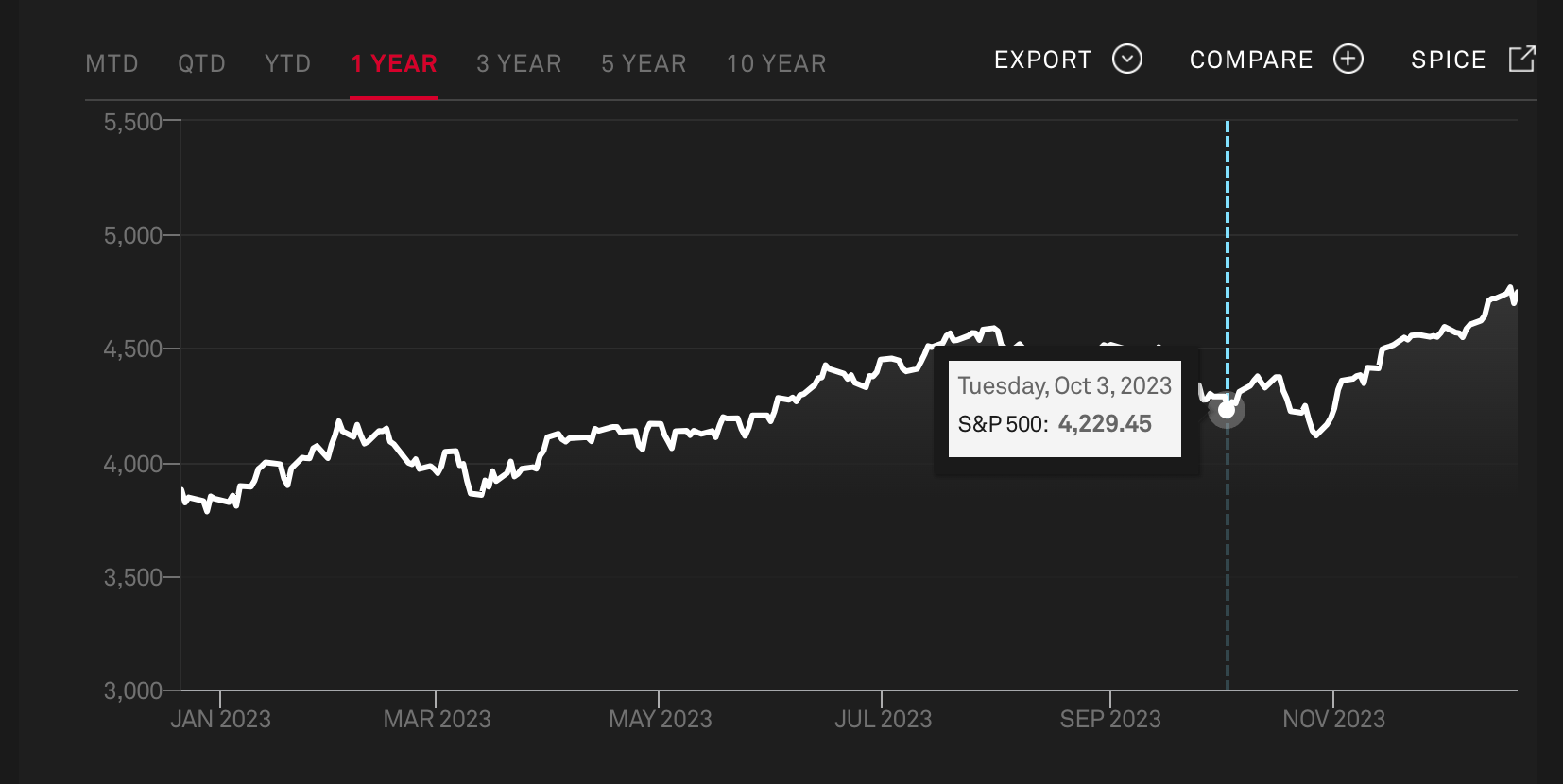

But first, let's consider how the S&P 500 itself did, so we have a good, base comparison to work with.

S&P 500

The S&P 500 price for beginning of October 2022 as around $3,678.

And on 1 Oct 2023, it was about $4,229.

I'm not taking dividend payments etc into account here, so the growth was $551, or just about 15%. My Interactive Brokers account reflected it as being around 11.3%.

Either way, pretty good! Better than I thought it would be, to be honest.

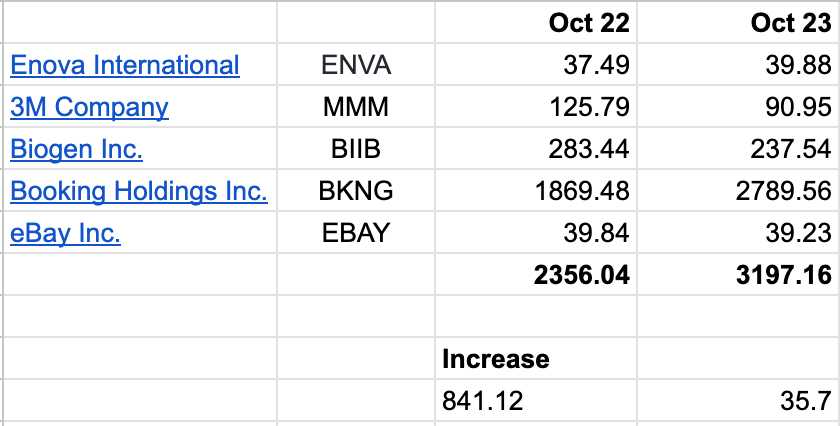

Static results from the suggestions on Oct 2022

The figures displayed are not the actual amounts and proportions of stock I purchased, only the price for a single unit of a stock, and how much that unit would have been worth in October 2023.

The aggregate result was a growth of about 35.7%.

Impressive at first glance, but on closer inspection it was all due to one stock. 😅

Booking Holdings carried the results entirely with a real superstar performance. If we take Booking out of the equation, the results would have been miserable.

So, an interesting results, but not really a real-world example, since one would assume that adjustments would have been made to holdings during the year.

Basing results off of a single snapshot for October 2022 is not realistic. Things change.

Real StockMonitor results for Oct 2022 to Oct 2023

And it's not only the market that changed.

As the year progressed, especially towards the end of 2023, I suspected that something was off with following a purely mathematical, mechanical results approach.

Buffet and Munger both insisted on one thing above all else - do they believe in the actual company and its leadership itself? And do they understand the market and what it wants?

AI might be able to do this this in the future too(I will certainly play around with it later), but for the present at least, StockMonitor is not capable of doing such intuitive value-judgements.

So I found my approach drifting towards StockMonitor only making suggestions, and then me doing more thorough research and a gut-feel estimates, before purchasing by the end of 2023.

That being said, the results well be looking at next was more a reflection of my earlier mechanical approach. I guess next year will be a better reflection of my new one.

That being said, let's look at the real-world results StockMonitor achieved during Oct 2022 to Oct 2023.

As a side note: I purchased on stock on different platforms, due to the economics of available investment products in South Africa, so this section will be a bit of a patch-job. Please bear with me.

I'll show the aggregate results from my portfolio on Interactive brokers first, and then a compiled Sheets doc containing the results from my other investment accounts.

At the end, I'll combine them to get a final estimate of performance.

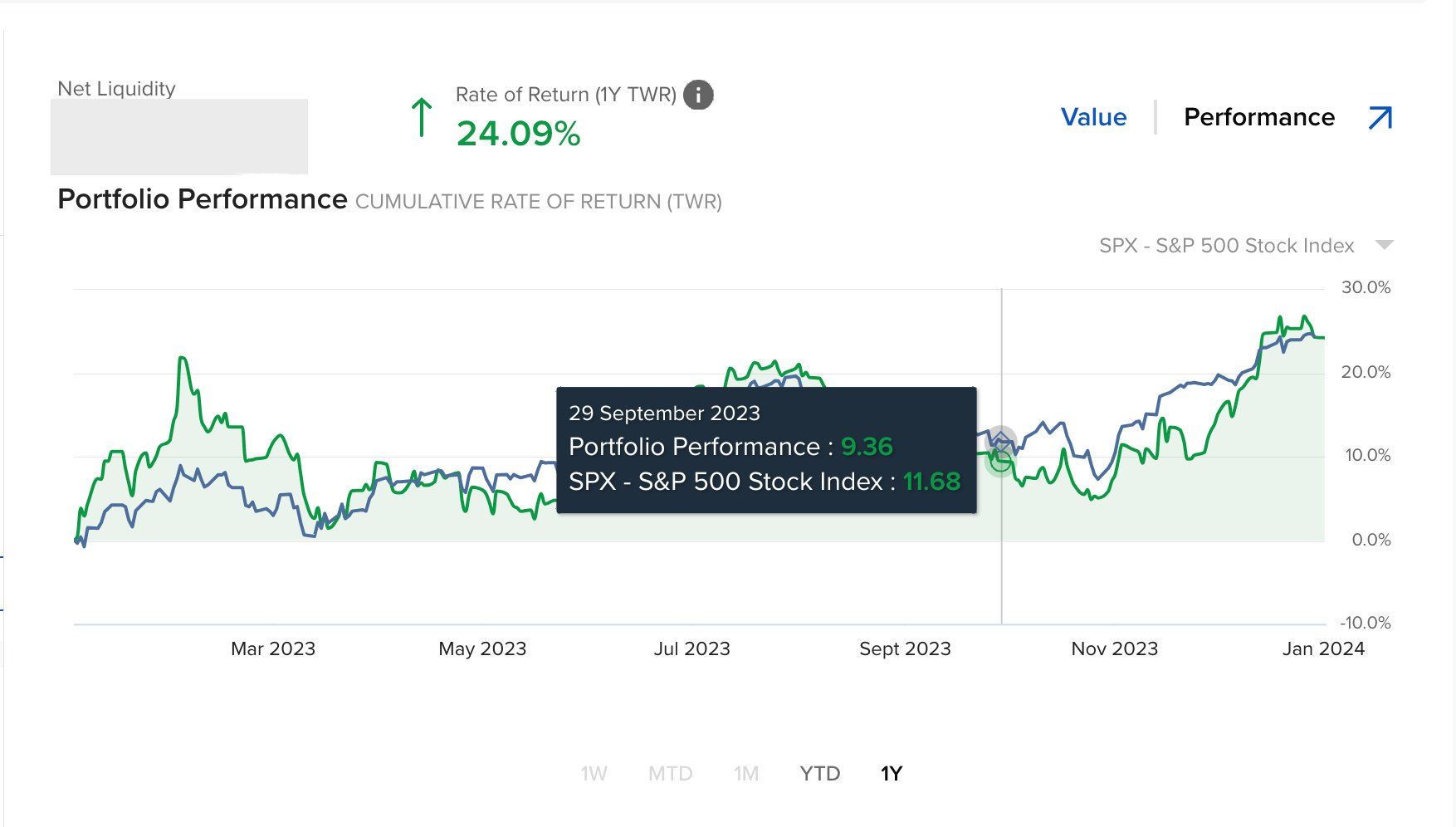

The performance was, shall we say, not great either.

StockMonitor did quite well during the beginning of the year(I Tweeted excitedly about it), but by the tail end of 2023, the S&P 500 came out ahead.

In short, you'd still have been better off holding the S&P 500.

The results on my Interactive Brokers account at beginning October 23 was around 9%(it recovered in Jan 2024 to around 24%)

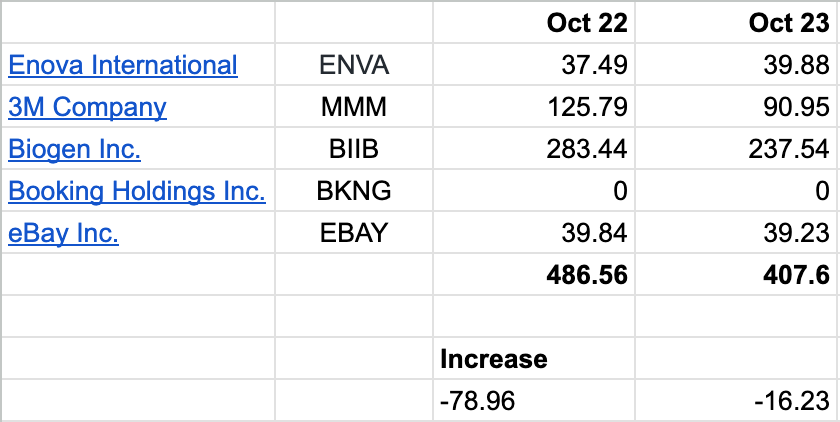

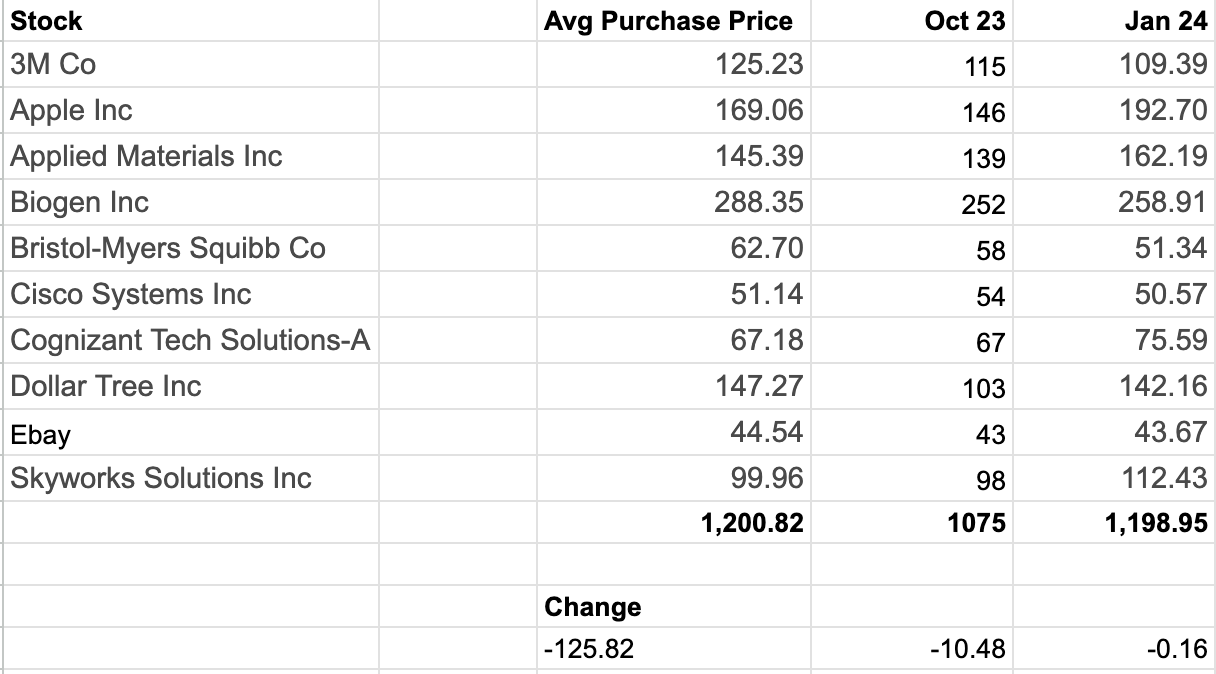

Now let's look at the cumulative results from my other investment accounts, for both October and the present.

A definite loss. Not good at all.

You'd have been waaay better of just holding the S&P 500(which gained around 11-15%, remember?).

Combining all the results above means that, on average, StockMonitor performed at around -0.75% compared to the S&P 500's 11-15%.

Terrible. 😅

What's next for StockMonitor?

Well, I certainly took notes and learned a lot during the year, and I've come up with an adjusted approach.

Going forward, I'm going to take StockMonitor results only as a starting point, just to narrow down companies to investigate manually.

I'll take the list of options it comes up with and only invest if :

- I see that the company in question has had continuous growth during the past 5+ years

- I understand exactly what the company does and what is required for it to continue doing well in it's market

- truly believe it will continue doing as good going forward, as it did in the recent past

StockMonitor is basically just a toy project for me at this stage. It's not ready to be trusted with anyone's money.

TBH, I lost some of the enthusiasm I had for it previously after this miserable performance.

I'll continue hacking at it and tweaking my approach to using it, but only for my own amusement and curiosity, not as a serious tool for investment.

It's currently at best a work in progress, and at worst a failure.